playa vista ca sales tax rate

The tax rate given here will reflect the current rate of tax for the address that you enter. The sales and use tax rate varies depending where the item is bought or will be used.

The County sales tax rate is.

. This is the total of state county and city sales tax rates. View more property details sales history and Zestimate data on Zillow. The cost of living in Playa Vista is 21 higher than the Los Angeles average.

The California sales tax rate is currently. See how we can help improve your knowledge of Math. There is no applicable city tax.

The statewide tax rate is 725. The minimum combined 2022 sales tax rate for Playa Del Rey California is. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35.

Type an address above and click Search to find the sales and use tax rate for that location. The Zestimate for this house is 907900 which has increased by 28448 in the last 30 days. The Vista California general sales tax rate is 6.

The 725 sales tax rate in Bella Vista consists of 6 California state sales tax 025 Shasta County sales tax and 1 Special tax. 55 rows The state sales tax rate in California is 7250. 5400 Playa Vista Dr Apt 23 Playa Vista CA 90094-2241 is a townhouse unit listed for-sale at 1590000.

The Isla Vista sales tax rate is. In November 2012 the residents passed Measure O a transactions and use tax which results in a sales tax increase of 0750 scheduled to be operative on April 1 2013. The 95 sales tax rate in Playa Del Rey consists of 6 California state sales tax 025 Los Angeles County sales tax and 325 Special tax.

4 rows The current total local sales tax rate in Vista CA is 8250. The complete property history is available in a single place including buyer and seller information detailed mortgage lien records distressed property records. Total Sales Tax 8375.

The Vistas tax rate may change depending of the type of purchase. There is no applicable city tax. Those district tax rates range from 010 to 100.

The Monte Vista sales tax rate is. Did South Dakota v. Playa Del Rey Los Angeles 9500.

There is no applicable city tax. The December 2020 total local sales tax rate was also 10250. The Playa Del Rey sales tax rate is.

This is a rare opportunity to obtain one of very few Skylar Penthouses located in Playa Vistas Phase II that is in a premier location with over 150000 of upgrades. The Vista California sales tax rate of 825 applies to the following four zip codes. With local taxes the total sales tax.

The minimum combined 2022 sales tax rate for Vista California is. Please ensure the address information you input is the address you intended. 13200 Pacific Promenade APT 434 Playa Vista CA is a condo home that contains 1149 sq ft and was built in 2003.

Average Sales Tax With Local. This is the total of state county and city sales tax rates. Sales history mortgages liens and pre-foreclosures for 6200 Playa Vista Drive Playa Vista.

There are approximately 83849 people living in the Vista area. A base sales and use tax rate of 725 percent is applied statewide. What is the sales tax rate in Monte Vista California.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The 825 sales tax rate in Vista consists of 6 California state sales tax 025 San Diego County sales tax 05 Vista tax and 15 Special tax. The County sales tax rate is.

The December 2020 total. Did South Dakota v. The California sales tax rate is currently.

The minimum combined 2022 sales tax rate for Monte Vista California is. California state income tax is 59 lower than the national. Some areas may have more than one district tax in effect.

California general sales tax is 42 higher than the national average. The Vista sales tax rate is. It contains 1 bedroom and 2 bathrooms.

The minimum combined 2022 sales tax rate for Vista California is 825. The California sales tax rate is currently. In addition to the statewide sales and use tax rate some cities and counties have voter- or local government-approved district taxes.

Solano County SalesTax 0125. There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. Townhouse is a 3 bed 30 bath unit.

The cost of living in Playa Vista is 71 higher than the national average. An alternative sales tax rate of 825 applies in the tax region Oceanside Tourism Marketing District which appertains to zip codes 92081 92083 and 92084. The minimum combined 2022 sales tax rate for Isla Vista California is.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Rio Vista SalesTax 0750. The County sales tax rate is.

Zestimate Home Value. The Rent Zestimate for this home is 3499mo which has decreased by. 92081 92083 92084 and 92085.

This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles.

The sales tax jurisdiction name is Los Angeles which may refer to a local government division. The California sales tax rate is currently. Playa Vista housing is 197 higher than the national average.

You can print a 725 sales tax table here. 4 rows The 95 sales tax rate in Playa Vista consists of 6 California state sales tax. CA SalesTax 7500.

California Department of Tax and Fee Administration Cities Counties and Tax Rates. The County sales tax rate is. What is the sales tax rate in Isla Vista California.

Total Sales Tax 8375. District tax areas consist of both counties and cities. 5 digit Zip Code is required.

How To Set Up Sales Tax In Quickbooks

Puerto Rico Sales Tax Rates By City County 2022

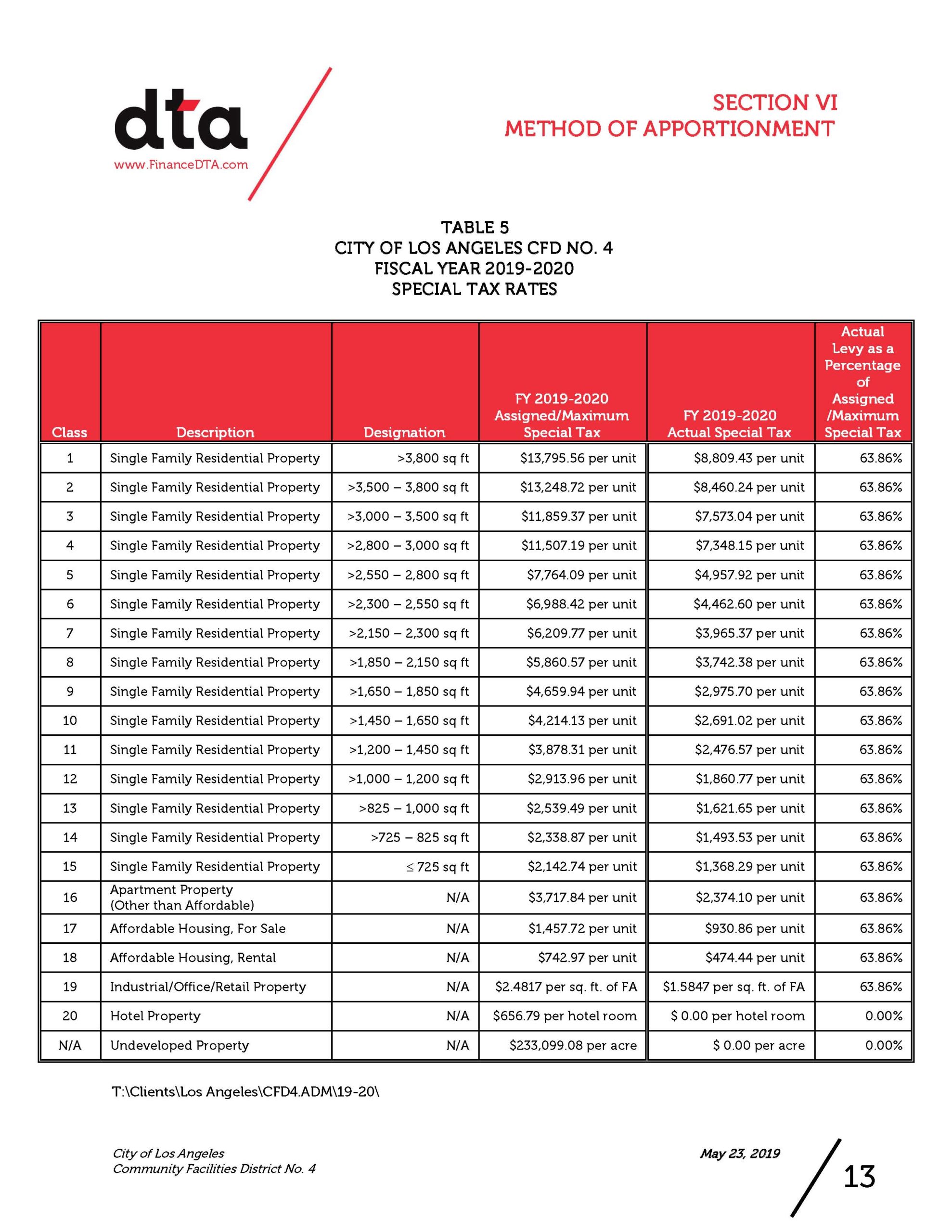

Is Mello Roos Tax Deductible In Los Angeles Ca By Playa Vista Experts

Who Pays What In The Los Angeles County Transfer Tax

How To Set Up Sales Tax In Quickbooks

Is Shipping In California Taxable Taxjar

Is Shipping In California Taxable Taxjar

California State County City Municipal Tax Rate Table Sales Tax Number Reseller S Permit Online Application

Small Business Sales Tax Guide Merchant Maverick

California Sales Tax Rates By City

California Sales Tax Rates By City County 2022

Who Pays What In The Los Angeles County Transfer Tax

Sales Tax Items Vs Sales Tax Groups In Quickbooks Pro Merchant Maverick

How To Set Up Sales Tax In Quickbooks

Grand Opening New Homes In Chino Hills Serena At Vila Borba Http Www Standardpacifichomes Com New Homes Standard Pacific Homes Youre Invited New Homes